Personal Representative: A Crucial Aspect of Estate Planning in Florida

When an individual passes away, their assets must be efficiently managed and distributed according to their wishes or the Florida Statutes if a person does not prepare an estate plan. In order to ensure a person’s wishes are followed, they should prepare a will and potentially a trust.

An estate plan sets out an individual’s wishes in the event they become incapacitated and can no longer manage their own affairs, as well as what will happen to their assets when they pass away. This usually involves creating a will, a health care surrogate, and power of attorney.

One important aspect a person must consider when preparing their estate plan is who they would like to appoint as personal representative to administer their estate and ensure their wishes are fulfilled. Other states typically refer to this fiduciary as an executor or administrator.

In this blog post, we will dive deeper into the role of a personal representative, the benefits they offer, and how to choose one under Florida regulations.

Understanding Personal Representatives in Estate Planning

This personal representative will be responsible for managing and settling all of the deceased person’s estate. They can be an individual or a professional entity, depending on the decedent’s preference and the complexity of their estate.

The Responsibilities of a Personal Representative

1) Initiating Probate

The personal representative should work with a skilled probate attorney to ensure the appropriate pleadings are filed with the proper court.

2) Inventory and Appraisal

The personal representative is responsible for creating a comprehensive inventory of all the relevant assets, including real estate, investments, bank accounts, and personal property. They may also need to obtain professional appraisals to determine the value of these assets.

3) Managing Debts and Expenses

Personal representatives must identify and notify creditors of the estate, then pay valid debts and resolve any resulting disputes.

4) Distribution of Assets

Once all debts, taxes, and expenses are settled, the personal representative will oversee the fair distribution of the remaining assets to the beneficiaries named in the will (or determined by state law).

Reasons to Appoint a Trusted Personal Representative

- Correct Estate Administration. A personal representative is responsible for ensuring the estate is accurately administered under the decedent’s wishes and in compliance with the applicable laws and regulations.

- Asset Protection and Management. The personal representative is responsible for identifying, inventorying, and valuing the assets, as well as safeguarding them against mismanagement.

- Expertise and Experience. Depending on the complexity of your estate, a personal representative with professional expertise (such as an attorney) can offer invaluable guidance throughout the process.

- Conflict Resolution and Mediation: In cases where disputes or conflicts arise among beneficiaries or potential claimants, a personal representative serves as a neutral party to facilitate resolution.

- Timely Estate Administration: The probate process can be time-consuming, but a reliable personal representative will ensure it moves along quickly with minimal delays and complications.

In short, a personal representative plays a pivotal role in estate administration and should be thoughtfully chosen when creating an estate plan. Their presence during this challenging and emotionally charged time can both simplify and expedite the process, ensuring the decedent’s wishes are carried out completely and accurately.

Importance of Choosing the Right Personal Representative

Selecting the right personal representative is key to ensuring the smooth administration of an estate. When it comes time for an individual to choose their representative, they need to look for someone who is…

- Trustworthy

- Competent

- Familiar with their affairs

- Available and willing

- Neutral

In certain situations, it may be beneficial to appoint someone with professional experience, such as an attorney, a professional fiduciary, or a bank’s trust department. This is especially true in situations involving complex or high-value estates.

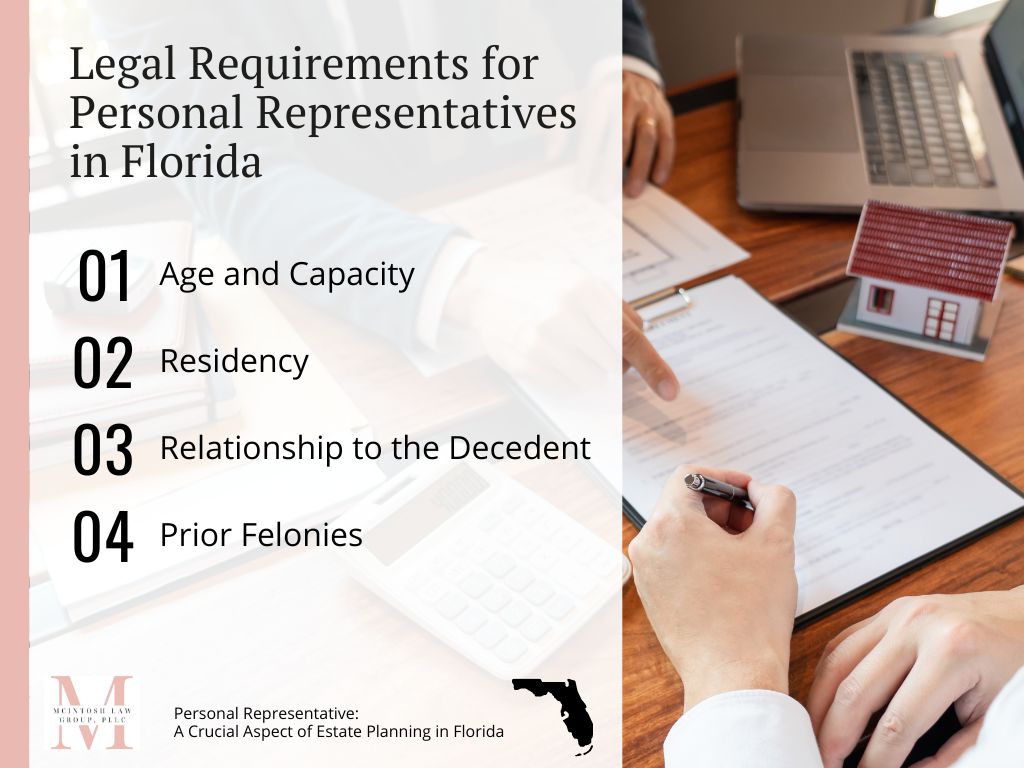

Legal Requirements for Personal Representatives in Florida

There are specific legal requirements that must be met for an individual to serve as a personal representative, as outlined in the Florida Probate Code. These regulations are designed to ensure the personal representative is qualified and capable.

The legal requirements for personal representatives in Florida include…

Age and Capacity

The personal representative must be at least 18 years old and of sound mind. Minors and individuals who are legally incapacitated are generally not eligible.

Residency

In Florida, a personal representative must be a resident of Florida or a blood relative of the decedent or the decedent’s spouse.

Relationship to the Decedent

Florida law establishes an order of priority for selecting personal representatives based on their relationship to the decedent. Generally, the surviving spouse is given priority, followed by other close family members.

If there is no eligible family member willing or able to serve, the court may appoint a qualified person or a professional entity.

Prior Felonies

If the personal representative nominated to serve or has the highest priority as determined by the Florida Statutes has been convicted of a felony, they are disqualified from serving. Additionally, if they have been convicted of abuse, neglect, or exploitation of an elderly person or disabled adult, they are disqualified from serving as personal representatives.

Contact McIntosh Law Group for Expert Estate Planning

Choosing the right personal representative is an integral part of ensuring that your final wishes are carried out efficiently and effectively. Their role in managing and settling your affairs cannot be overstated.

Colleen McIntosh is here to help you choose the ideal representative. She has years of experience executing wills, helping to distribute assets, and overseeing the probate process.

If you live in Florida and have questions about estate planning, schedule a complimentary consultation today or call (727) 404-2018.